Technology

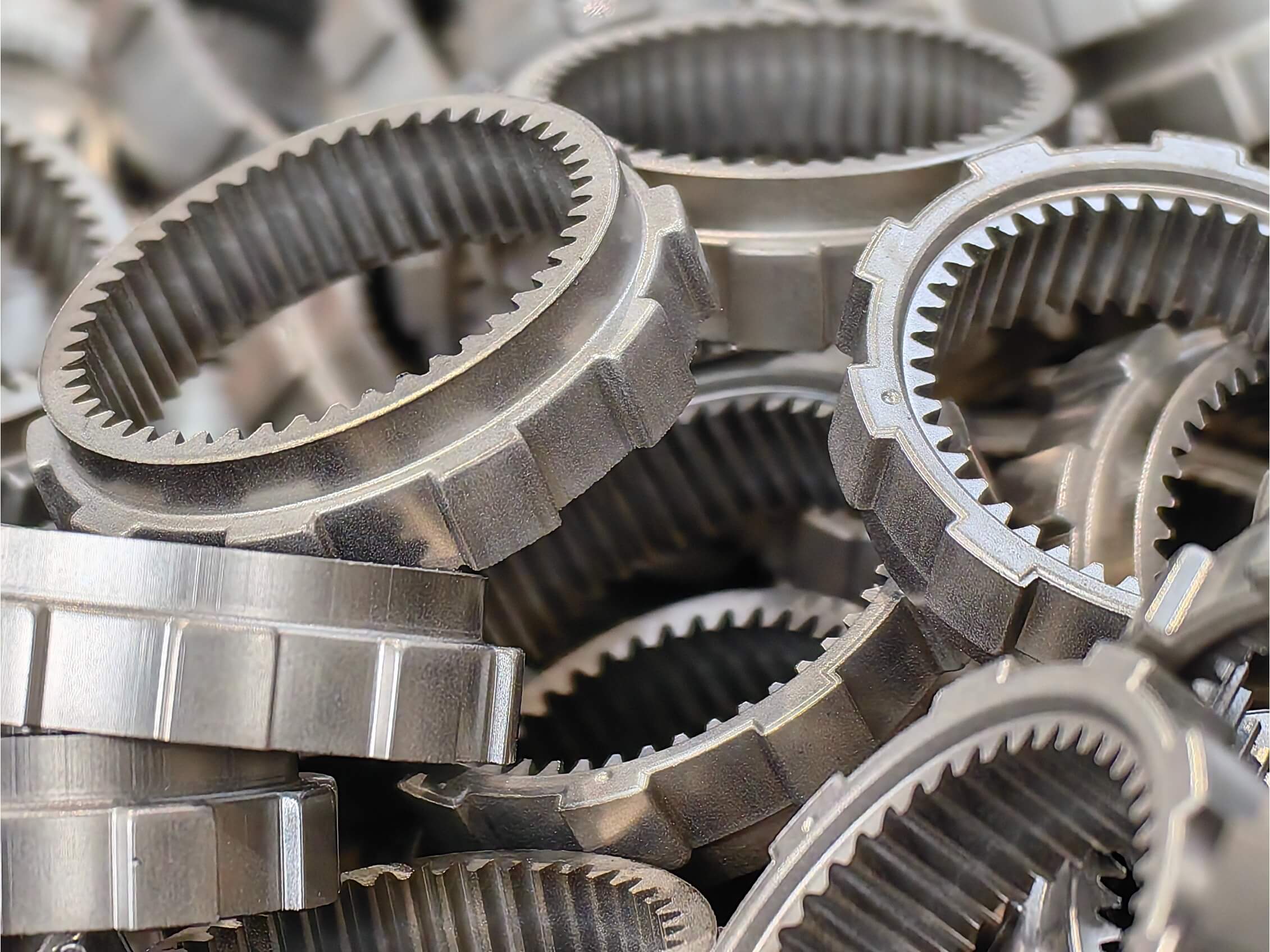

Powder metallurgy [PM Sinter]

Sintering – classical powder metallurgy is the production of metal products from powders by pressing and subsequent high-temperature sintering in furnaces.

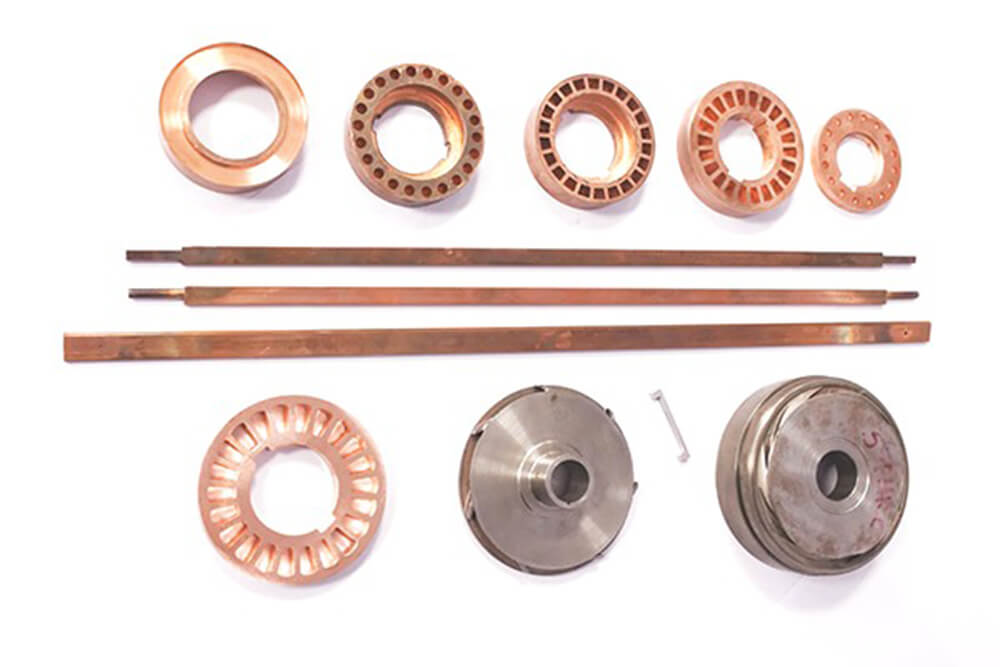

Metal injection moulding [MIM]

This technology is based on three basic processes: selecting the right combination of metal powders and polymers, injecting the material into the mould and sintering in special furnaces.

Hot Isostatic Pressing [HIP]

Hot isostatic pressing is the process of compacting powders or castings and sintered parts in a furnace at high pressure and temperature.

Additive manufacturing [AM]

Additive manufacturing is the deposition of fine layers of metal powders on a 3D printer followed by sintering.

Why invest in GEVORKYAN

GEVORKYAN offers an interesting investment opportunity in the growing powder metallurgy sector. With a strong market position, proprietary technologies and a focus on custom solutions, we are well positioned to take advantage of industry trends such as sustainable manufacturing.

We are focused on expanding our product portfolio, entering new markets and leveraging partnerships to drive growth. Our investments in robotics and new technologies are expected to deliver significant value in the coming years.

Profitable revenue growth

Long-term contracts

Technology leadership

Strong and improving margins

Global expansion

Green initiatives

Revenue growth (2024)

EBITDA margin (2024)

2026 contractual revenue

Resources for investors

2024 and 2023 in accordance with IFRS standards; 2022 in accordance with Slovak GAAP

| 2024 | 2023 | 2022 | |

|---|---|---|---|

| Revenue | €75.69M | €60.77M | €45.52M |

| EBITDA | €26.37M | €20.77M | €18.21M |

| Net income | €3.79M | €3.83M | €3.45M |

Performance of shares

Development of Gevorkyan shares on the Prague Stock Exchange. Updated daily.

Shareholder structure

As at 31 December 2024

| Artur Gevorkyan | |

| The Jeremie Fund | |

| Versute BHS Fund | |

| Free Float, of which | |

| – Institutional investors | |

| – Private investors |

Management

Artur Gevorkyan

Chairman of the Board of Directors

Artur Gevorkyan, a military aeronautical engineer, founded GEVORKYAN a.s., a world leader in powder metallurgy. His entrepreneurial journey began in Ukraine in 1991, where he established Ukraine’s first private manufacturing plant. Realizing the potential for greater growth, Artur moved to Slovakia in 1996, where he laid the foundations of GEVORKYAN. Today, the company is known for its innovation and achieves annual growth of 20-30%. Artur’s strategic vision continues to drive the company’s success and appeal to international investors.

Andrej Bátovský

Chief Financial Officer

Andrej Bátovský serves as Chief Financial Officer and Chairman of the Supervisory Board of GEVORKYAN. He played a key role in the company’s successful listing on the Prague Stock Exchange, which marked the largest IPO on the PX Start market with a volume of approximately EUR 29 million. Andrej has risen from humble beginnings and his leadership and financial talent were recognised when he was named CFO of the Year 2023. This prestigious award celebrates his exceptional contribution to modern financial management, talent development, innovation and sustainable business practices.

FREQUENTLY ASKED QUESTIONS

How to invest in GEVORKYAN?

Where to find Gevorkyan stock

Prague Stock Exchange (PSE)

- Instrument name: GEVORKYAN

- Short name/sticker: GEV.PR

- ISIN: SK1000025322

- Currency.

Bratislava Stock Exchange (BSE)

- Instrument name: GEVORKYAN

- Short name: GVR

- ISIN: SK1000025322

- Currency.

Some brokerage firms for investing in Gevorkyan:

Patria.cz | LYNX | Interactive Brokers | BH securities | Fio banka | J&T BANKA

What reporting standards does GEVORKYAN follow?

GEVORKYAN prepares its financial statements in accordance with International Financial Reporting Standards (IFRS) as adopted by the European Union.

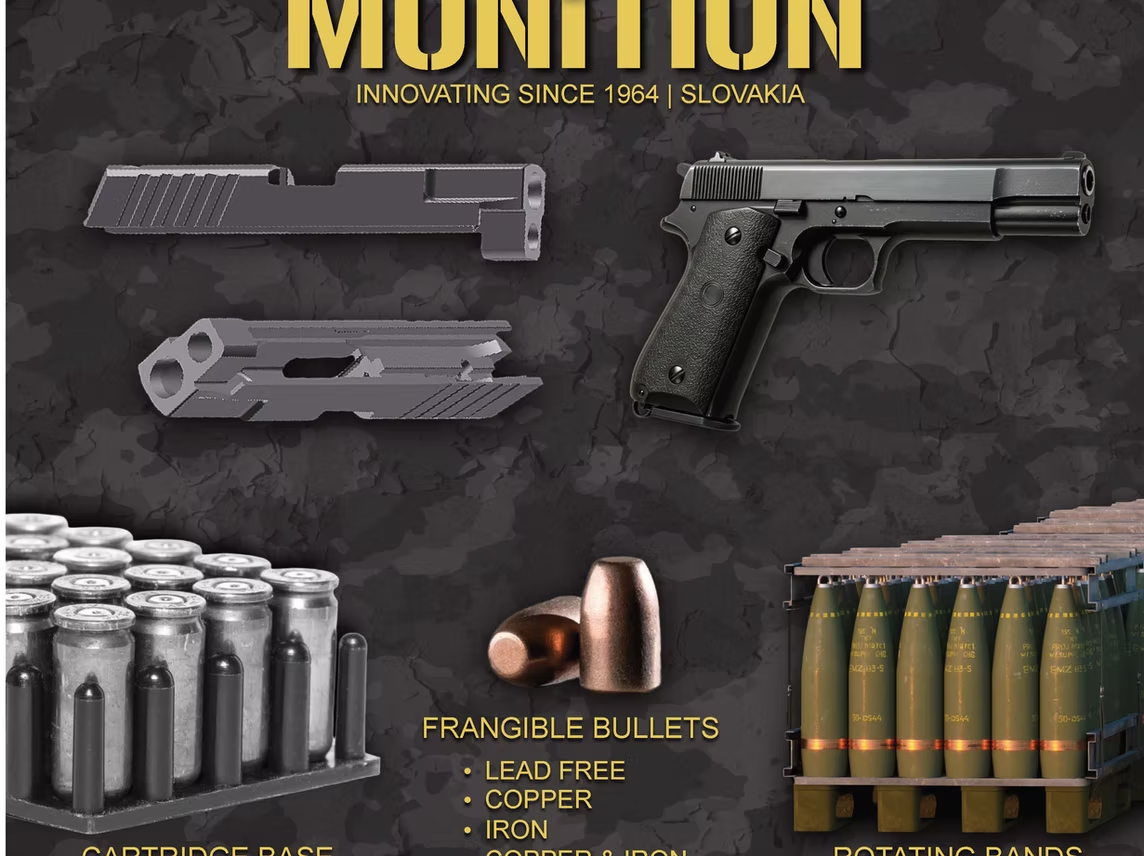

What are GEVORKYAN's recent strategic acquisitions?

GEVORKYAN integrated the operations of Altha and SKF, transferring business operations from competing companies in Italy to Slovakia. These acquisitions are expected to contribute additional annual revenues of EUR 12-14 million.

What are GEVORKYAN's sustainability activities?

GEVORKYAN has issued green bonds to invest in environmentally friendly technologies and has installed photovoltaic panels covering approximately 25% of its total energy consumption.

What is GEVORKYAN's financial outlook for the coming years?

GEVORKYAN plans to grow revenues from EUR 82.5 million in 2025 to EUR 121.8 million by 2029 and to increase EBITDA to EUR 38.88 million over the same period.

Does GEVORKYAN have any outstanding bonds?

Yes, in October 2024 GEVORKYAN placed a second tranche of green bonds worth EUR 7.5 million. More information can be found in the Debt & Bonds section.

Does GEVORKYAN have any financial obligations?

Yes, GEVORKYAN has covenants, including a net debt to EBITDA ratio of less than 5 and compliance with other financial ratios. For more information, see Debt and bonds.

What is the free movement of GEVORKYAN?

As of December 31, 2024, GEVORKYAN’s free float was 17%.